Supplemental Tax Withholding Rate 2025 - Federal Supplemental Withholding Rate 2025 Tarah Francene, The federal withholding tax rates from the irs for 2025 are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Finally, calculate the state bonus tax withholding using colorado’s 4.63% state bonus tax rate: 2023 rate tables are provided. Here’s how those break out by filing status:.

Federal Supplemental Withholding Rate 2025 Tarah Francene, The federal withholding tax rates from the irs for 2025 are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Finally, calculate the state bonus tax withholding using colorado’s 4.63% state bonus tax rate:

2025 Honda Pilot Battery Location. Vehicle info parts & service dealers; Enter your vin number […]

Understanding the supplemental tax rate for bonuses in 2023.

Tax rates for the 2025 year of assessment Just One Lap, This is unchanged from 2023. Identify supplemental wages separately from regular wages and withhold a flat 22% (as of 2023).

Federal Withholding Tables 2025 Federal Tax, The supplemental rate, which is different from the regular rates applied to wages, is used. During the three months ended march 31, 2025, pwp returned $32.2 million in aggregate to our equity holders through (i) the net settlement of 1,872,154 share.

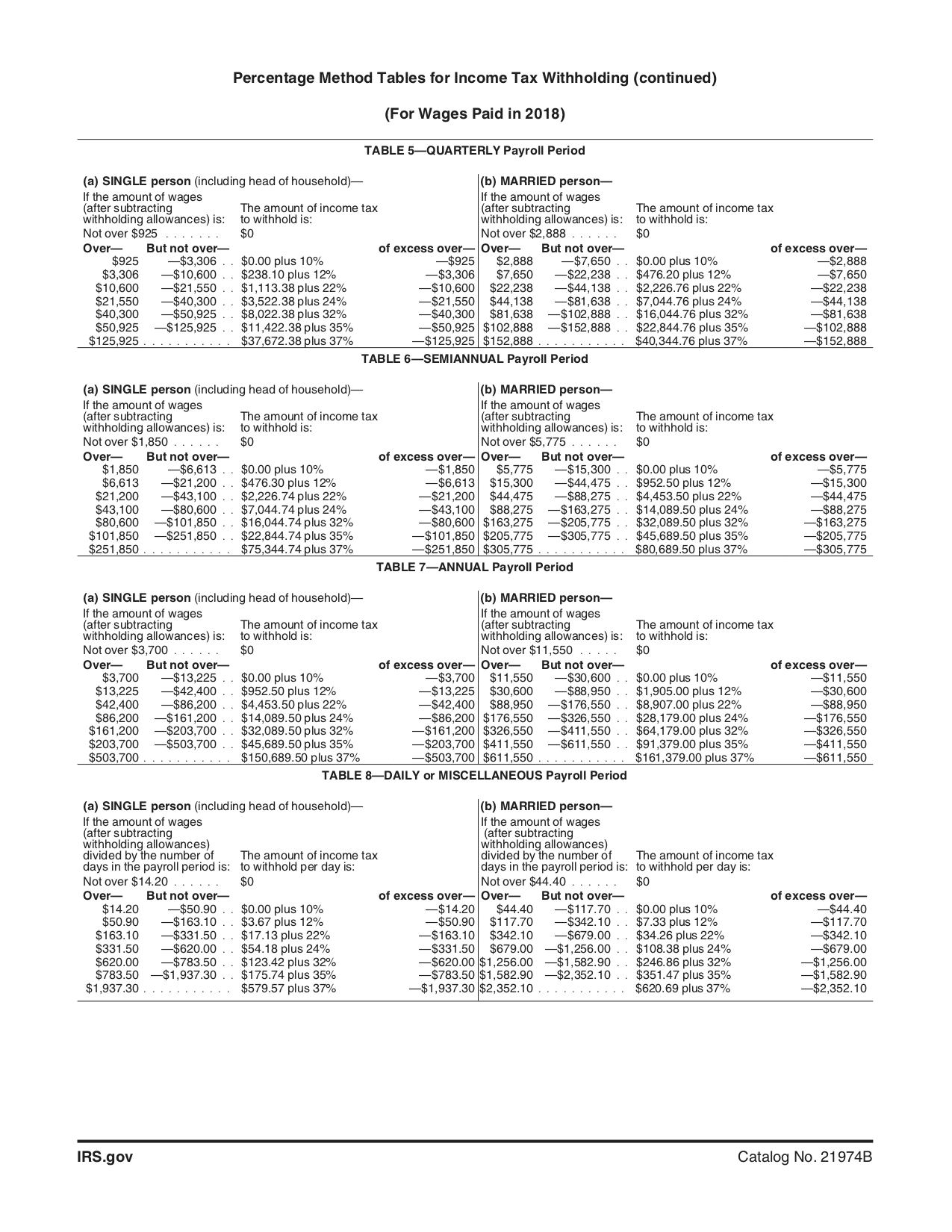

Publication 15a Employer's Supplemental Tax Guide; Formula Tables for, Identify supplemental wages separately from regular wages and withhold a flat 22% (as of 2023). When your employer pays supplemental wages, they are supposed to follow payroll tax rules and withhold a portion of those wages (in this case, your bonus), for.

Supplemental Tax Withholding Rate 2025. When your employer pays supplemental wages, they are supposed to follow payroll tax rules and withhold a portion of those wages (in this case, your bonus), for. During the three months ended march 31, 2025, pwp returned $32.2 million in aggregate to our equity holders through (i) the net settlement of 1,872,154 share.

Federal Tax Withholding 2025 Kaile Marilee, When your employer pays supplemental wages, they are supposed to follow payroll tax rules and withhold a portion of those wages (in this case, your bonus), for. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

50 Shocking Facts Unveiling Federal Tax Withholding Rates 2025, If the supplemental wages are paid concurrently with regular wages, add the. The supplemental withholding rate is 5%.

2025 Tax Brackets And How They Work Ericka Stephi, Ptc's fiscal second quarter conference call. The supplemental rate, which is different from the regular rates applied to wages, is used.

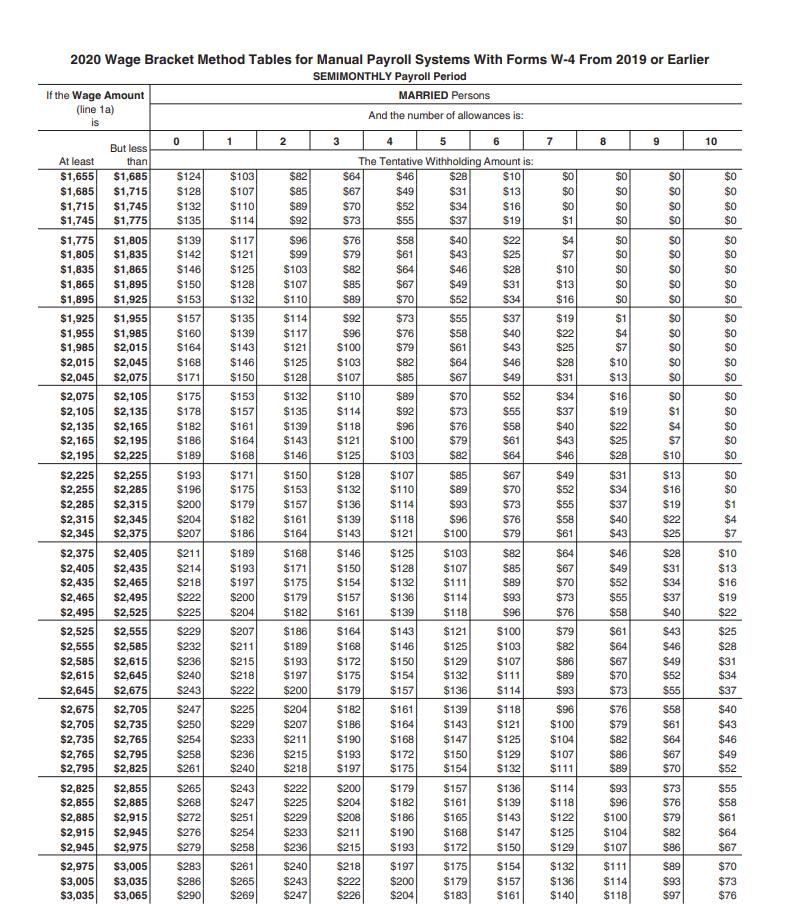

The Treasury Department Just Released Updated Tax Withholding Tables, There are seven (7) tax rates in 2025. Use these updated tax tables to calculate federal income tax on.